|

|

|

#1 |

|

Banned

|

Ironic News Story

As Graduates Move back home, economy feels the pain, by the New York Times

Is that really how the economy works? Seriously? Spoiler: show [Placed in debate because of potential for conflicting views.] |

|

|

|

|

|

#2 |

|

beebooboobopbooboobop

|

? Spending always strengthened the economy. Trickle down is cutting taxes for the top few so they can spend more, but it fails to acknowledge that most spending is from the middle class.

What I'm getting from this article is that this situation is a vicious cycle-graduates aren't spending to save money because the economy sucks, and in turn, make the economy worse.

__________________

|

|

|

|

|

|

#3 |

|

The Path of Now & Forever

Join Date: Mar 2007

Posts: 5,304

|

I skimmed it once, then ate a bit of lunch. Now it's asking me to log in =/

The way the trickle down effect is supposed to work is that by cutting taxes on large businesses and the rich, they're free to hire more staff. Then that staff has income, which they can then spend and boost the economy. Unfortunately, as Tdos said, most of the spending (in America) is done by the middle class while large companies are starting to send money overseas through outsourcing, causing American dollars to not help the American economy. Or even worse, hidden away in a Swiss bank account. Although, some can argue that there are still many lower and middle class Americans who send money back to their families in other nations, I don't think this percentage of revenue lost is even remotely as much as money put into outsourcing. |

|

|

|

|

|

#4 |

|

Banned

|

Trickle down, is cutting taxes (for all that are taxed), to allow the people more money to spend on more goods and services, as well as to invest.

The rich get more money to invest in making more money, which in turn, promotes growth. A business owner (who is more often than not, NOT rich), gets a loan from a rich person, to start or expand a business. Both sides make money. The problem with outsourcing jobs, is that, Business Regulation is so Prohibitive, and expensive (time and money), that it's often either not a choice, or the most appealing choice, to source the jobs to cheaper labor in a different country, then to remain. The consumers demand their products at a certain price, and that price can not be met without cutting costs. Yeah, profit is also a reason, which is precisely why the government should make it MORE profitable for businesses to keep jobs here, then to keep slapping regulations, taxes, and mandates on businesses in order to "better the world," "make people pay their fair share," "show compassion," or other such nonsense. "It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest" - Adam Smith The Wealth of Nations People are going to act only in their own self interest, and no amount of regulation, speeches, and government mandates are going to change that. That is why it is imperative to link one person's self interest, with everyone else's self interest (Which is the essence of free, uninhibited capitalism) Last edited by unownmew; 11-17-2011 at 03:13 PM. |

|

|

|

|

|

#5 |

|

The hostess with the mostess

Join Date: Mar 2007

Posts: 226,522

|

Does this count as ironic? It's certainly startling considering who wrote it. What are your thoughts on this, unownmew?

http://online.wsj.com/article/SB1000...WhatsNewsThird |

|

|

|

|

|

#6 |

|

プラスチック♡ラブ

Join Date: Mar 2007

Location: 蒸気の波の中

Posts: 14,766

|

You're making a lot of risky assumptions.

>Trickle down, is cutting taxes (for all that are taxed), to allow the people more money to spend on more goods and services, as well as to invest. That isn't the Reganomics model. Correct me if I'm misinterpreting this, but the Trickle Down theory cuts taxes for the top so that the impact would flow to the bottom. Taxation rates would still be roughly the same down the line, however. >The rich get more money to invest in making more money, which in turn, promotes growth. This is assuming that the rich are going to spend their money domestically, which doesn't happen all that often, from what I understand. Many companies hide their money away to avoid taxation (and still make money doing that!) or will invest in foreign capital because it's more competitively priced. >A business owner (who is more often than not, NOT rich), gets a loan from a rich person, to start or expand a business. Both sides make money. This is making the assumption that, in a bad economy, people are going to be willing to take the risk to start or expand a business, which is really not very common or likely. >The problem with outsourcing jobs, is that, Business Regulation is so Prohibitive, and expensive (time and money), that it's often either not a choice, or the most appealing choice, to source the jobs to cheaper labor in a different country, then to remain. The consumers demand their products at a certain price, and that price can not be met without cutting costs. I'm not sure that it lies solely in the cost of regulations and taxes - the fact that Americans are just plain expensive to hire makes a lot of the difference. Is this fixable? No, probably not; we're pretty spoiled as a culture and we're unlikely to told to accept less in hard times because they're hard times. >Yeah, profit is also a reason, which is precisely why the government should make it MORE profitable for businesses to keep jobs here, then to keep slapping regulations, taxes, and mandates on businesses in order to "better the world," "make people pay their fair share," "show compassion," or other such nonsense. If you're going to accuse the government of strangling American business, you might as well specify what you're referring to. Making broad, sweeping statements about taxation and regulation makes you sound like a radical and a tad ignorant. Regulations are necessary for keeping the market relatively balanced and fair, at the very least, and prevent criminals and monopolies from dominating the markets. Taxes are necessary for keeping the government running and doing the things it does well; we gotta get them from somewhere, and companies are the easiest place to get them from, considering their revenue mass. I'm not really sure why they are cast as such terrible things. Sure, there's definitely a fine line, but regulation and taxation are so heavily demonized as lump sum concepts that it seems like some conservatives would rather just play the markets like the lottery, which is not a great idea as a large-scale economic model. |

|

|

|

|

|

#7 | |||||||

|

Banned

|

Quote:

Government hates to be limited, and will Always try to expand itself, which is precisely why "Government is at best, a necessary evil, and at worse, an intolerable one." I'm curious why you find irony in the author of the subject matter. Jerichi, I do appreciate you addressing me point by point here, it makes it clear, and ensures each point is addressed instead of conveniently ignored. Quote:

I don't see why Reaganomics would by definition Exclude Tax breaks down the line, and down the line would certainly be more effective then just the rich, but you are right, it is usually attributed to just cutting Taxes for Rich. (which are defined by Democrats by the amount of money they earn, starting at $250,000 a year all the way up to billionaires, and not by their living expenses (not lifestyle expenses), which often results in lower living quality in high-expense locations like New York and California, in the lower ends of the brackets) The Real reasoning behind Reaganomics though, consists of a few different things, not just the result "Lower Taxes for Rich". For one, it involves broadening the tax base (50% or so of Americans today don't pay any taxes, and 10% or so already foot 40% of the bill), it is the real "Everyone pays their fair share," Tax plan, because it makes the 50% non-payers start paying at least some of the bill. The Second part of it, is, Incentivization. (Spoiler for background) Spoiler: show Who would want to have 50+% of their entire income taken forcibly from them? Very few right? And so, instead of striving for the very top, those people will instead opt keep themselves in the safe. That's why so many rich people go to great lengths to shelter their money. Reaganomics uses various incentives to promote people working for their betterment, and increasing their social standing. When they do this, the poor become richer, the rich become richer, and society as a whole grows. No one is left out, if they're willing to work for it. Welfare is in direct opposition to this idea, because if someone can live (however meagerly) without having to do anything for themselves, some people will. I'm not opposed to helping the poor, and those who have fallen on hard times, but, it is better to provide them more methods to better themselves, and let them be responsible for their own lives, then to "compassionately give and give and give forever" The third, is partly incentive, the lower taxes. The rich Invest money in order to make money. When the rich have more money (due to the lower tax rates), they can invest more money in possibly profitable ventures. When the ventures turn profit, both the Investor and the Invested, make money, which then allows them both to turn around and invest again for an even greater profit. This is what grows an economy. When the rich lose money, there is less money to invest in profitable ventures (the middle class can't invest unless it's in mass, and the poor can't invest at all). Both are vicious cycles. One goes up, and the other goes down, and neither of them can sustain a flat-line Rant: Spoiler: show Quote:

That's another reason Reaganomics is so crucial, if you have high taxes on the rich corporations, they'll just go elsewhere to make a profit, and our Society will be less well off. Quote:

Quote:

Quote:

Quote:

I assume Taxes and Regulations are demonized as lump sum concepts, because there are simply too many to specify in one sentence, and many that only lawyers can actually understand. |

|||||||

|

|

|

|

|

#8 | |

|

我が名は勇者王!

|

Quote:

Trickle down doesn't work because of the diminishing marginal utility of goods/services. The rich can be satisfied by the same luxuries the middle class, so there are fewer venues for them to actually spend that money without it being perceived as "wasteful". Sure, you see well publicized lavish spenders on TV, but these people are actually the exception. Most people worth a billion dollars are still worth a billion dollars from year to year.

__________________

あなたの勇気が切り開く未来

ふたりの想いが見つけだす希望 今 信じあえる あきらめない 心かさね 永遠を抱きしめて |

|

|

|

|

|

|

#9 | ||

|

Banned

|

Quote:

Quote:

Trickle down does work. Tell me, if you were worth $1 billion cash flow (so you don't have to worry much about running out of money over time), would you really, honestly, truthfully, settle for middle-class amenities? You would ride economy class in public airplanes, buy used cars, and bargain hunt for clothes and food? Even if you would, many others would not, nor would they need to. Once you've reached the point where you no longer need to work survive, you can spend your excess money on whatever you feel like. Rich people employ a very large amount of people, and continually invest their money to make more money, they also spend large amounts of money on frivolities, so they can enjoy the wealth they've worked so hard for. Rich people invest in middle class start-up ventures, employ middle class people, often at very high rates to keep them working for them, and provide a demand for expensive products made by the rising middle class business owners. Each action is much more beneficial to the economy then anything a middle class person could do. The richer the rich get, the more money they spend on better and newer products, which reduces the price of other, older products, which then puts them in the price range of middle class families, increasing the standard of living of the entire society. The richer the rich get, the more they can pay their workers, which increases the standard of living for the entire society. |

||

|

|

|

|

|

#10 |

|

時の彼方へ

Join Date: Mar 2007

Location: Lafayette, Indiana

Posts: 20,578

|

"can" versus "do" seems to be the disconnect you're having between theory and practice. Maybe if American companies had the same level of integrity as (increasingly historical) Japanese companies where the CEO makes barely more than the lowest salaried employee, then yeah. But in America where CEOs are constantly gifting themselves exorbitant salary bonuses and (even more ridiculous) hefty severance packages when they leave the company, you're not likely to find a company who sees 10% increase in net revenue dump even half of that back into their employees' salaries and wages. Almost all of it either goes into upper management's paychecks or else into investment. The latter is fine, but it's no different from the former as far as the impact it has on the middle and lower-level employees' salaries and wages go.

__________________

|

|

|

|

|

|

#11 |

|

The hostess with the mostess

Join Date: Mar 2007

Posts: 226,522

|

I found it ironic because she was lumping Tea Party and OWS together. Considering most TP members (hehe TP) generally don't care for OWS. So it was a bit of a shocker to see something like that from Palin, who has denounced OWS in the past.

|

|

|

|

|

|

#12 | ||

|

Banned

|

Quote:

Quote:

"The grass roots movements of the right and the left," Well, at least she mentioned that the TEA partiers were right, and the OWS people need to wake up to the real corruption. Last edited by unownmew; 11-20-2011 at 08:16 PM. |

||

|

|

|

|

|

#13 |

|

プラスチック♡ラブ

Join Date: Mar 2007

Location: 蒸気の波の中

Posts: 14,766

|

>I was talking about individual rich, not companies. Individual rich, when they have a worker they really like, such as a maid, butler, private jet pilot, mechanic, etc., sometimes pay them exorbitant salaries to keep them from looking for another employer.

That represents SUCH a small margin of the economy that it's practically insignificant. Here's the problem: most of what you're talking about would work if you have tax breaks for banks or companies, NOT the independently rich individuals. Banks lend money to middle-class start-ups. Companies provide products and drive the economies. Yes, rich people purchase goods, often very expensive goods, but they do not do so with much frequency or in great numbers. I can bet you that companies like Ford and GM are not making most of their money from their high-end luxury vehicles. I bet technology companies, like Apple, HP, Dell and Microsoft, don't make their money off massive custom-made computers. They make their money off the mid- and upper-middle class people purchasing in troves and businesses buying servers, computers, and software in bulk. Rich people are often going to sit on their money as well, which doesn't do anything for anyone except for them. The middle class drives our economy. They are the ones purchasing most of the goods and moving the most money between hands, which makes economies healthier. Giving the middle class serious tax breaks or real motive to spend otherwise is going to get things going again. If the middle class feels they have enough money, they'll invest in smaller investments in greater numbers. Take the housing market for example. The housing market is driven mostly by middle and lower class people buying and selling their homes. Sure, rich people have some impact but their involvement in the housing market is not going to be a big margin because of the infrequency of their home purchases. If we make middle class (and possibly even lower class) people more confident in their economic status, they'll be more willing to move, putting life back into the festering housing industry, and they'll do it en masse. Realtors will start to make money, builders will start to build, employing workers and contractors, markets will be shaken up, new interest will be generated, tax bases and consumer markets will be revitalized. Giving money to the upper class will not directly cause this to happen. Reagenomics can work, in theory. But it's a rather indirect and roundabout means of aiming for a goal that focuses on the middle class. And why wouldn't you support the middle class? It seems silly to support the rich when, even in the Reagenomics model, we still have the middle class's vitality as our ultimate goal. Not to mention, the middle class is pretty much the picture of the American dream. It looks great for America as a country if we can boast a thriving middle class. If you want Trickle Down to work, focus on making things more appealing for corporations, not for the rich individuals. The corporations having more confidence will bring more corporations back to the US, creating jobs and what have you. This will also create more opportunities for consumers to consume, since companies having more money gives them the freedom to create new demand by creating new products. I don't entirely disagree with you (I tend to be more fiscally conservative anyways), but I think your methods seem needlessly convoluted and miss the true core of the American economy: the middle class. |

|

|

|

|

|

#14 |

|

Banned

|

You're absolutely right, companies and banks drive the economy as well, just as you said.

The kicker here, is, the profits of businesses, large or small, generally, unless they are Corporations (which are doubly taxed), are taxed as the Owner's income. Every profit the business makes, is considered a portion of the individual's income, and the individual is taxed on it. This puts them in the "Rich" tax bracket as a individual, even though they have less money they can actually use to live on, and less money to invest in he business. Which is why taxing "Rich" (as defined by the democrats as those making $250,000 a year and up), is so debilitating to the economy, and why easing the burden for them is so inline with what you just said. It's not just corporations, but all types of businesses that need appealing taxes to help the economy. |

|

|

|

|

|

#15 |

|

プラスチック♡ラブ

Join Date: Mar 2007

Location: 蒸気の波の中

Posts: 14,766

|

Well, then, I think we need to redefine and simplify the tax code. That seems to always be what causes us the trouble at the most fundamental level, no?

I think everyone (except for the IRS workers, of course) would agree that's a good idea. |

|

|

|

|

|

#16 |

|

Banned

|

Completely agree with you there. Just don't add double taxation to the other non-corporate businesses.

I'm all for a flat tax, maybe with a couple deductions for charitable donations. Make it simple, and I won't mind paying a couple percentage points higher then normal, just nothing worse then 34% |

|

|

|

|

|

#18 | ||

|

Problematic Fave

Join Date: Sep 2011

Location: VA

Posts: 3,199

|

Quote:

I just wanted to address this little statement because it tickled me so much. Quote:

Hahaaaaaahahaha! >Then we'll have two classes of society, those who work hard, and foot the tax bill, but can't afford to better themselves or those around them, and those who do not work, and are sustained by the work of the working class. Of course there will be the rich ruling class as well, but that will be a minority.   >implying the richest .01% of the country doesn't own more than the rest of the country combined The thing is, unownmew, that you don't seem to understand that we've been through all this already, as has Congress, laudable institution that it is. Welfare has a cutoff date, but it really is a good thing that you didn't know that. Unless you want to hold your own against Talon, that is. Maybe more later, I have an essay to finalize.

__________________

|

||

|

|

|

|

|

#19 | ||

|

Banned

|

Quote:

Quote:

|

||

|

|

|

|

|

#20 | |

|

Banned

|

Quote:

S-corp and LLC(corp) businesses are taxed on a personal level, because everyone else prefers it that way (who would want to pay their taxes twice?). They also have some regulations that Corporations don't, but owners prefer to have the Legal Protection having the business considered a separate entity affords them. |

|

|

|

|

|

|

#22 | ||

|

Problematic Fave

Join Date: Sep 2011

Location: VA

Posts: 3,199

|

Quote:

Disability payments? No, foo. If you broke both your legs and then they set so that you couldn't walk without pain, would you want people to send you money for six months and then stop? What if you lost limbs in a horrific industrial accident? Would you accept a six-month disability payment? I was speaking of welfare payments; lose your job, you get paid to look for another one. If you haven't found one by six months, the money stops coming. Quote:

Disability payments are not the issue here, and the issues they do have are not ones I'm comfortable discussing. Especially disability payments to veterans. For hemorrhoids and STD's. But meh, I doubt any lame schlepped-together facts from the recesses of my brain are going to convince anyone, and they're probably false anyway. Feel free to believe what you want to believe.

__________________

|

||

|

|

|

|

|

#23 | ||||||

|

我が名は勇者王!

|

Quote:

Quote:

Quote:

Quote:

The rich might be wealthy, but no real person is so rich that he/she could consistently commission private video games made exclusively for them. Such people only exist in fiction. They have to settle for the mass market goods/services. Quote:

First off, not all corporations are created equal. I'd love to see heavy taxes for media conglomos like Viacom, NewsCorp and Disney, but not necessarily for companies that operate on razor thin profit margins for important technology or products. My father's company produces instruments that are essential to every hospital in the US, but even with outsourcing and the cheapening of materials, they are barely profitable under current laws. Lifting restrictions only benefits the company marginally because there's not a tremendous demand for the instruments, but imposing more restrictions forces the company to operate at a net loss. Secondly, corporations exist to mitigate risk, allowing the people hiding behind the back of the corporation to take more risky ventures without fear of personal loss. In the financial industry, the money is loaned to the corporation from regular people, other corporations or banks, so who actually manipulates the money is at least twice removed from who lends it. The more removals one has, the more difficult it is to ensure accountability. And since everything is based on risk/reward, if you incentive corporations to take risk, those running the corporations will indulge in more risky behaviour, because there is effectively no personal risk to them. The mass speculation and baton passing of bad financial packages we saw in 2008 and in 2000 were due to tax and regulation incentives on corporations. Incentivizing their behaviour is the last thing we need to do to stabilize the economy. To go back to my gnarled old stump stance, the major problem with the US is over-population. Technological improvements lead to increased efficiency and productivity with fewer input of labour. Said technological improvements also allowed for more distributed wealth, leading to a higher birth rate with a dramatically lower death rate. Higher population in turn diluted the wealth ushered in by the technology and is putting stress on a regression of the standard of living. Unless Obama institutes a massive, paid government plan for young folk to leave the country and help build up sub-Saharan Africa or something, the US would struggle with population even without the immigrant problem because people are living longer. Quote:

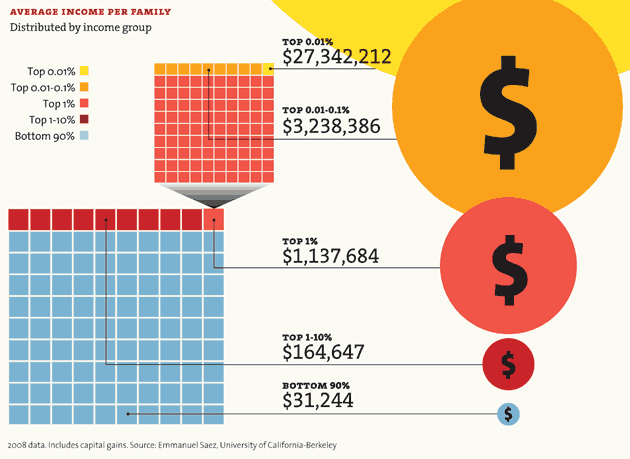

300,000,000 people /4 = 75,000,000 families. 90% of 75,000,000 = 67,500,000 families .01% of 75,000,000 = 7,500 families 67,500,000 * $31,000 = $2,290,500,000,000 7,500 * $28,000,000 = $210,000,000,000 That's $2.3 trillion versus $210 billion. The top 1% are somewhere in the vicinity of $845 billion. Or in other words, 99% of the US makes 10 times as much as the top .01%. Is there a disparity? Yes (they should be making 1000 times as much). Does it matter? No, because the 90% bulk is clearly a better source of revenue on average than the top .01%. It's not even close. I don't believe in trickle down, nor do I believe that the top .01% will really miss those extra millions due to the decreasing utility of money. But inequality is retarded.

__________________

あなたの勇気が切り開く未来

ふたりの想いが見つけだす希望 今 信じあえる あきらめない 心かさね 永遠を抱きしめて Last edited by Doppleganger; 11-22-2011 at 06:29 PM. |

||||||

|

|

|

|

|

#24 |

|

Barghest Barghest Barghe-

|

That is of course assuming the the majority of Americans make the same amount of money. Which they don't.

The reason there is higher taxes on the rich is because INDIVIDUALLY they have more money than the average American. Sure, combined the normal American income surpasses it, but INDIVIDUALLY, which is how taxes are done, they have much less cash on hand than the rich. The rich can foot a bigger burden because to be quite frank they simply have more money. If a rich man has 11 million dollars, and has 1 millon taken out in taxes, is that really a big deal? It is easier to make 1 million dollars 1.1 than 100 11o, is it not? Henceforth, the poor and middle classes are hurt more than the rich are.

__________________

|

|

|

|

|

|

#25 | |||||||||||

|

Banned

|

So you're in favor of double taxation then?

What the business makes, is taxed, and then what's left over is available for business operations and the owner's personal income. And then the Owner is individually taxed again on whatever amount he pays himself. Quote:

Quote:

Not ALL welfare is temporary, and the standards for applying for the permanent welfare are lower then you'd think. Yeah, losing a limb is serious, and IF it prevents you from working, it's worthy for payments. Losing a finger does not prevent one from working, but it can be considered payable for welfare, if you phrase it right on the form. The issue isn't disability payments, you're right, the issue is easily obtained, and encouraged permanent welfare. We're not completely there yet, thankfully, but it's not too far away. Nationalized Healthcare is the first spearhead of many. Quote:

As you can see, fewer people are responsible for more of the bill, then the middle class, but the middle class certainly is paying a large portion. Quote:

What I was trying to get at, is that, the rich are consistently working at earning more money, be that by buying and selling, or just sitting on growing assets. Sometimes they lose, sometimes they stay even, and sometimes they get more. Their money is not entirely constant. Quote:

Quote:

Quote:

In other words: Regulations as a whole are bad. (that's not to say some may not be necessary, but, the majority of them are not necessary) Quote:

Quote:

Incentivizing businesses to expand and hire and operate in America by reducing taxes and regulations, and creating a more business friendly enviroment, is a very good thing to do. Incentivizing Rich people to invest in American businesses and products, by providing tax breaks , is a very good thing to do. Quote:

Alternatively, we could just anex or buy some portions of Africa, Asia, Middle East, or South America, then let our entrepreneurial people build it upon their own instead of paying people to move with other people's money. It creates jobs, and eases the overpopulation. Quote:

That is the price of freedom. But, with freedom, comes the ability for everyone, no matter how disadvantaged they are, to improve themselves, according to their efforts. With Tyranny and absolutely enforced equality of station, that ability is severely diminished, almost to an impossibility. |

|||||||||||

|

|

|

|

Lower Navigation

Lower Navigation

|

||||||

|

||||||

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

| Thread Tools | |

|

|